Disclaimer: This is not financial advice, I am not a financial advisor, this is just my experience and things I have found that help. None of the apps or websites mentioned here have paid to be mentioned, they are literally ones I use and have found through trial and error.

Introduction

I used to be terrible with money, constantly spending, racking up debt, and not doing much to change it. It took me a while to figure things out, but now I work part-time and have more money than ever. More importantly, I’ve learned how to control my spending.

Little did I know that my ADHD was working against me the entire time. While luck and generosity played a role in my journey, I want to share how I finally took control of my finances, along with tips that helped me along the way.

TLDR: I struggled with money due to ADHD, impulsive spending, and debt. Despite earning more over time, I lived paycheck to paycheck until a job loss in 2022 forced me to change. I now work part-time, have financial stability, and control my spending. Key lessons: understand spending triggers, set savings goals, limit easy access to spending, embrace frugality, and separate unexpected money. Change is possible!

Early Years: Learning to Earn

I’ve never been a stranger to hard work. I started working at 13 because my parents didn’t have much disposable income. If I wanted something, I had to earn it myself. Fortunately, online shopping wasn’t as accessible back then, so I didn’t develop spending issues until later.

When I went to university, things changed. I received a full bursary and loan, which covered my education without parental support. Like many students in the early 2010s, a lot of this money went toward alcohol, takeaways, and cheap clothes. Looking back, I could have been more responsible, but I had a good time!

The Debt Spiral Begins

After my undergraduate degree, I pursued a master’s while earning only £8,000 a year. My rent alone ate up most of that, leaving me with about £300 per month for everything else. My tuition was £5,000, which I was lucky enough to have covered for me.

However, I started using credit cards more than I should have. By the time I completed my master’s in 2014, I had about £5,000 in debt, partly due to overspending and an expensive holiday.

One smart move I made was transferring my debt to interest-free credit cards. Even though I had bad spending habits, I at least understood how to avoid high-interest payments. And can honectly say I have had to pay a total of less than £100 interest in my entire life (if you do not include the interest on my mortgage)

Entering the Workforce

When I started my first full-time job, my salary was around £17,500. I was aware that I had a spending problem but wasn’t interested in fixing it. I had a plan to pay off my debt, but I kept spending money as if nothing had changed.

Luckily, I received a few pay raises and a promotion. A generous person also paid off my debt under circumstances that meant I didn’t have to repay it. By 2018, my partner and I bought a house, thanks to a gifted deposit. Financially, things looked stable, but my spending habits hadn’t changed.

I could save when I had a goal, like a holiday, but I couldn’t save just for the sake of it. My income kept me from going back into debt, but I was still living paycheck to paycheck.

The Wake-Up Call

The COVID-19 pandemic initially forced me to curb my spending since I couldn’t travel or go out. However, I developed an unhealthy relationship with online shopping, spending at least £20 a week on clothes and constantly ordering from Amazon. In fact, in the month before I lost my job in early 2022, I spent around £800 on Amazon purchases alone.

Losing my job was a turning point. I had some savings from not traveling during covid, but now, for the first time, I couldn’t spend. Oddly enough, this was a blessing.

Since I was studying part-time, I couldn’t immediately get a full-time job. Instead, I took on two part-time jobs, earning around £16,000 before tax. After expenses, I had just enough to get by.

During this time, I received £15,000 from an unexpected source, which I still haven’t touched because I don’t consider it “my money.” This shift in mindset was crucial—I finally started viewing money differently.

I worked these jobs for a year and also took on a short-term research post that paid an additional £3,500. Though I wasn’t fully in control of my spending, I was no longer reliant on credit cards.

Then, I began teacher training, which came with a tax-free bursary of £27,000 and a £9,000 student loan. This gave me the highest take-home pay I’d ever had—around £3,600 per month. I’m happy to say I did save some of it, but not nearly as much as I should have!

Financial Transformation

Whilst doing my teacher training, is when I realised that I could not continue spending the way I was. Weirdly, whilst I knew this, the change came about strangely. By this point I had dabbled in various investment and various side hustles, but I had never really seen my spending as a huge issue, despite knowing I needed more.

The biggest change came when I downloaded an app for abstinance. I downloaded it as I wanted a way to count how long it had been since I last used a photo filter. That was 385 days ago, if you wondered.

The app I use (Quitzilla) gives you a number of days you haven’t done the thing you are attempting to not do and then gives you mini targets. Using this for filters made me start wanted to try it for other things, essentially I was/am addicted to the dopamine from reaching each of these targets.

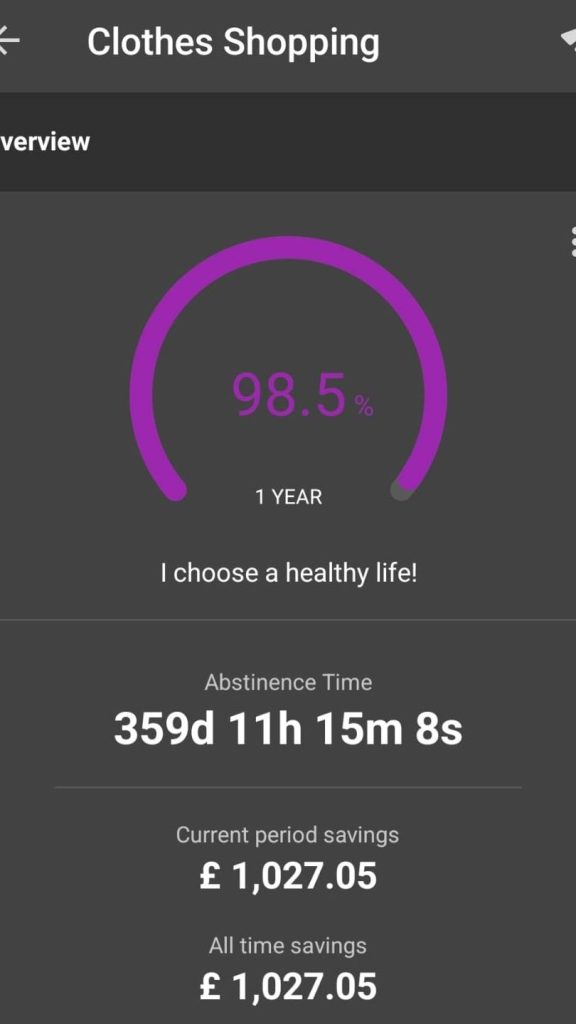

After some thought I decided to cut out clothes shopping, which has long been an addiction of mine. I have watched it tick over from 1 week, 2 weeks, 1 month, 3 months, 6 months, and now I am approaching 1 whole year of not buying any clothes. It gives me an estimate of what I have saved based on the information I provided it. I have given a screenshot of this below:

I now use the same app for a number of different things, some to ensure I minimise my spends at Starbucks, some to ensure I minimise my time online. I genuinely find it really useful. And for me it works. If I want to buy clothes I will lose a whole year of progress. Alongside this I have started selling clothes on Vinted, feel free to browse my wardrobe here https://www.vinted.co.uk/member/81763366 I have so far made £250 on Vinted, which I do not think is too bad for the minimal effort required! Its not going to make you rich but I am using it to pay for random non-necessities here is a referral link for anyone interested https://www.vinted.co.uk/invite/properkate!

Holidays

I have saved a lot of money by not travelling since covid. I have been to Northern Ireland 3 times, and I visit my parents, but that is about the limit of my holidays since 2019. Which looking at that now, is quite the stretch. This has been mostly driven by my partner, who is the exact opposite of me and hates spending money with a passion.

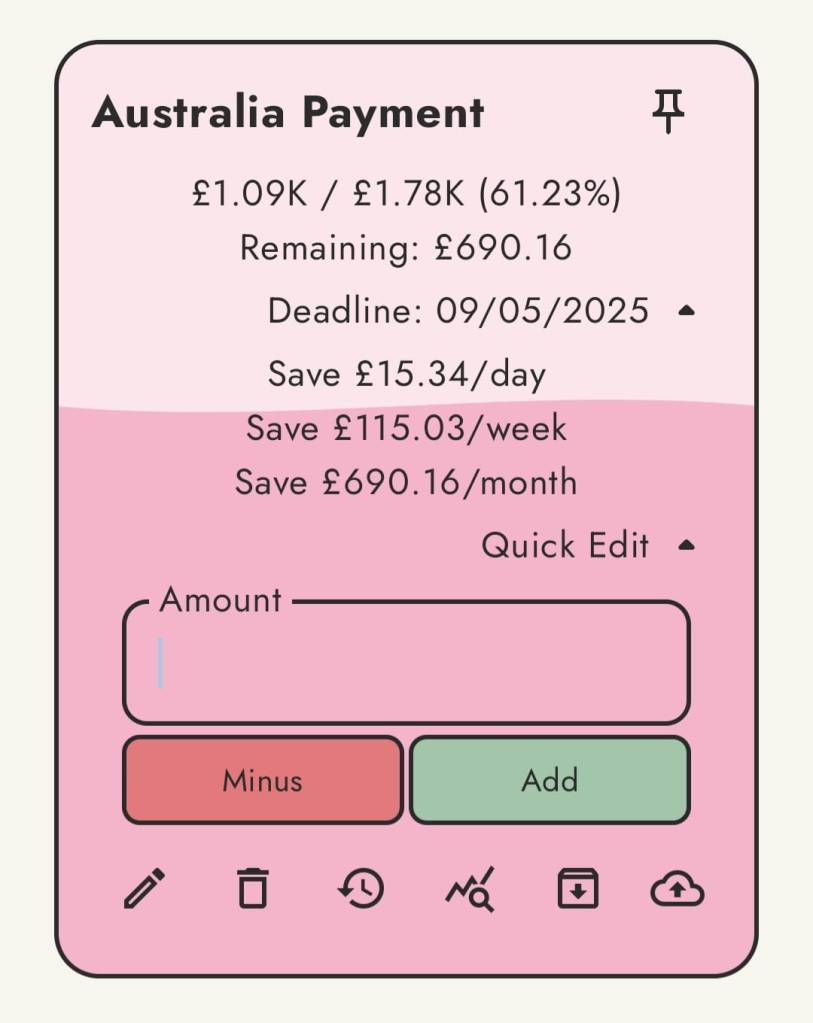

I did however recently decide that this is the year I will be going back to Australia, and that my partner was coming with me. I therefore bought the flights and put these on my credit card, with the payment pending on the 9th May. Whilst I have the money saved to pay for these I am reluctant to use it. Therefore I did what I always do and looked for an app that could help gamify this for me. I found JamJars. Essentially you give it your target and it calculates how much you need to save a day in order to reach your goal. It is also really cute. I like it because I do not need to move my money into a different account, I can use an existing savings account and then just use JamJars in order to track it. As you can see, I only bought the flights on Sunday and I have already save 61% of my flight up (my partner is paying for their own flight).

I also have one set up for my spending money. I like these because it breaks down what I need to save into a daily target, which means I can try to find ways to reach that, whether it is listing a few things on Vinted, doing a few consulting hours or selling something random I can figure out how much I need and take it from there.

Where am I at now?

I have spent a lot of time talking about my past and giving some random apps I use that help me (that I 100% recommend btw). I guess what I have not done is talk about what I earn now!

I currently work as a teacher 4 days a week, through this my take home pay is around £1600 after deduction, £1000 of this goes on the house (mortgage, bills, joint savings), the remaining £600 is used for food and other expenses. It is not a lot, but not buying clothes has helped there!

On top of teaching I do a small amount of consulting (in the area I used to work), this does not bring in a huge amount at present, but it gives me a small amount of additional income to play with. Very occasionally I sell things I have made, though without a social media presence that has been increasingly difficult so it is only the odd job here and there!

so what can you learn from me and my story?

I have talked A LOT and currently it may not be overly helpful, luckily for you all I have summarised my top tips below. Now I could easily include that you should budget, but personally I find budgeting the epitome of boring and so I just cannot do it. Instead I know that I have to spend £1000 to the joint account and then the rest is my money to spend how I wish.

1. Gamify Savings

Like I have suggested, I use apps that allow me to almost make a competition with myself to see how long I can go without buying things. Spending money feels good because of the dopamine attached, therefore if you can make not spending money give you the same thrill you are onto a winner!

2. Have Clear Goals

I have always found that if I have a clear savings goal it makes it far easier to save. By clear I mean a set amount and a set time frame.

This is very much inline with the first tip, and having a clear goal in the beginning makes it much easier to gamify it!

3. Invest in your future

Something I have not discussed in detail here is the idea of investing. Both financially and educationally. If you currently work a job with limited financial potential look at whether there are any free courses available that will open up more opportunities for you. If you have money you want to save look at investment opportunities – Warren Buffett is perhaps the ultimate long term thinker, and patient investor. He thinks of investing as an analogy to growing a tree – you may plant the seeds today, but you have to wait many years to enjoy the shade. Investing is not a short term thing, it may take a long time for you to see the gains, so only invest what you can afford!

Both of these are things I follow, I am maybe a little too obsessed with the education side!

4. Monetise your stuff/hobbies

I am not suggesting everyone goes out and starts a business and ruins their hobbies, but most people have something that they can monetise. I am not suggesting that you aim to make millions by doing so (but power to you if you do), what I am suggesting is that if you know you have something expensive coming up that is out of your normal budget then look at how you could make that money outside your normal job. Maybe, like me, you have a lot of clothes you have not worn for years that no longer fit that you can sell, or you enjoy making greetings cards, maybe you have a skill that you can use to make money. Not everyone has something they can do here, but most people do. I would recommend you do not pick something entirely new that is going to cost you a lot of money. For me, my hobbies come in short bursts so I will sell to people I know and then move on to the next hobby. Potentially annoying, but it allows me to do something I enjoy and covers the cost of the hobby!

Conversely, you can save money by learning new skills, I have tiled and fitted two bathrooms, refitted a kitchen using existing cabinets, plastered a wall, refloored my entire downstairs. All of these things have saved me significant amounts of money over time!

5. Reduce | Reuse | Recycle

Bear with me…I know you have all heard this all the time for years, but this is something I truly believe in.

My family has always been great at reusing things and recycling things into new uses.

We have lived in our house for 6 years now, and we have only spent around £250 on free-standing furniture. Everything we have is furniture people we know no longer needed, some was even on its way to the tip. I have even built some of my own furniture out of leftover DIY materials. Sure some of it is not exactly what I would have picked, but it’s useable and I have the skills to make it work for me!

I have a garage full of random things I have collected, but over time I have slowly been utilising these.

We live in a society that has taught us to get rid of things before they are broken and to not fix the things that are broken. For me this is just wasting money.

Leave a comment